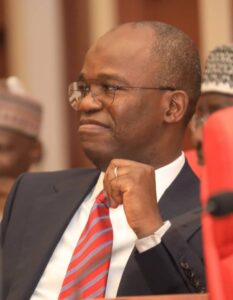

Kakalistiq.com reports that the Senate Committee on Banking, Insurance, and Other Financial Institutions, led by Senator Mukhail Adetokunbo Abiru, FCA, took a significant step forward on Wednesday, February 28, 2024, as they deliberated on a bill seeking amendments to the Central Bank of Nigeria (CBN) Act 2007. The Nigerian Senate, during its session, passed the crucial amendment bill for its second reading, marking a milestone in the legislative process. The bill had initially been introduced in the Senate on January 30th, 2024.

Spearheaded by Senator Abiru, a retired bank chief executive representing Lagos East, the bill garnered support from 41 co-sponsors within the committee. In his address during the debate, Senator Abiru emphasized the necessity of updating the CBN Act to empower the apex bank to fulfill its mandates effectively, especially in light of the evolving financial landscape and challenges faced in monetary policy implementation due to fiscal dominance.

“The current Act of 2007, which charges the Bank with the overall control and administration of the monetary and financial sector policies of the federal government, has not been amended for over 16 years despite growing changes to the Bank’s balance sheet as well as challenges in monetary policy implementation occasioned by fiscal dominance and the rapidly changing financial landscape,” he said.

The proposed amendments aim to foster coordination between monetary and fiscal policies through the establishment of a Coordinating Committee for Monetary and Fiscal Policies. This committee, chaired by the Minister of Finance, will work towards aligning targets for both policies to control inflation and promote sustainable economic growth. Additionally, the bill seeks to impose limits on fiscal deficits to prevent direct monetary financing by the CBN, among other measures aimed at enhancing policy effectiveness.

One of the significant provisions of the bill is the proposal for a six-year single-term tenure for the Governor of the CBN and deputy governors, along with fixed terms for external directors appointed to the CBN board. Furthermore, the bill recommends promoting internal talent by mandating the elevation of at least one career staff member to the position of Deputy Governor within the bank.

In line with efforts to enhance compliance and oversight, the bill suggests the establishment of the office of a Chief Compliance Officer within the CBN, with the rank of Deputy Governor. This officer would report directly to the board and provide accountability to the National Assembly.

Regarding ways and means, the bill proposes stringent guidelines for the CBN’s provision of temporary loans to the Federal Government, including limits based on average government revenues and repayment terms to mitigate default risks.

In a separate development, the Senate Committee on Banking, Insurance, and other Financial Institutions conducted screening exercises for four directors of the CBN, namely Mr. Robert Agbede, Mr. Ado Yakubu Wanka, Prof. Muritala Saba Sagaji, and Mrs. Muslimat Olanike Aliyu, underscoring the Senate’s commitment to ensuring competent leadership within the apex bank.